A lifetime of care exhausted as a toddler?

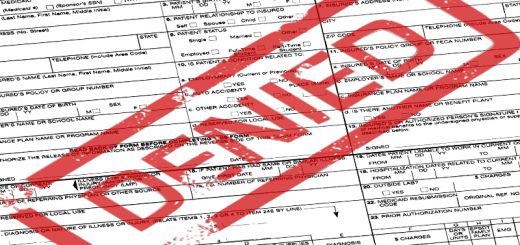

One of the pernicious terms we get to learn about when faced with major health care costs is “lifetime maximum benefits”.

This phrase used to mean serious financial jeopardy – if not an actual death sentence – for those with major health problems, by setting an overall limit to how much insurance will pay in an entire lifetime. Many policies carried limits of $1-2M, a seemingly high number if all you need is routine care – over 50 years your insurer could spend $20,000 year, a more-than-workable budget for healthy people. The story was far different for those with chronic conditions, or with major health crises like Wes. Healthcare, particularly in the US, is extraordinarily expensive and $2,000,000 doesn’t go as far as it used to.

Prior to 2010, after you hit your policy’s lifetime limit you were effectively uninsured – it didn’t matter whether you had a policy or not, your policy wouldn’t pay a dime towards new costs. In 2010, the ACA largely banned these limits from most policies.

Wes’ current bills – in less than two months, while not even 3 years old – amount to a significant percentage of a $2M lifetime limit, if they were still legal. There are many line items in his bills for more than $50,000 each from early November – by my figuring he consumed $75,000 worth of drugs in the first week after his diagnosis alone.

It’s not an exaggeration to say that if we return to pre-ACA rules as so many would like, Wes would exhaust a lifetime of coverage before his fourth birthday, and there is no conceivable way for working class mortals to afford the costs of the treatments he requires.

We’ll sell everything and bankrupt our families to keep him in recovery, but we don’t believe that should be necessary in the wealthiest country on earth.